Some Known Facts About Mortgage Broker Assistant Job Description.

Wiki Article

The Ultimate Guide To Mortgage Broker Salary

Table of ContentsWhat Does Mortgage Broker Assistant Mean?What Does Mortgage Broker Mean?Get This Report on Mortgage Broker Average SalaryNot known Facts About Mortgage Broker MeaningMortgage Broker Assistant Can Be Fun For AnyoneNot known Details About Mortgage Broker Meaning The Only Guide for Broker Mortgage CalculatorRumored Buzz on Mortgage Brokerage

What Is a Home loan Broker? The mortgage broker will certainly function with both celebrations to obtain the private approved for the car loan.A mortgage broker usually works with many various lending institutions and also can use a variety of finance alternatives to the consumer they function with. The broker will accumulate details from the specific and also go to several lending institutions in order to locate the finest potential finance for their client.

Broker Mortgage Near Me Fundamentals Explained

All-time Low Line: Do I Need A Home Mortgage Broker? Working with a home loan broker can conserve the debtor time and effort throughout the application process, as well as possibly a lot of money over the life of the loan. In enhancement, some lending institutions work specifically with home mortgage brokers, suggesting that debtors would have accessibility to loans that would certainly otherwise not be available to them.It's vital to take a look at all the charges, both those you might need to pay the broker, along with any charges the broker can help you stay clear of, when evaluating the decision to function with a home mortgage broker.

What Does Broker Mortgage Calculator Do?

You've most likely listened to the term "home loan broker" from your property representative or good friends who've purchased a home. What specifically is a mortgage broker and also what does one do that's various from, state, a funding police officer at a bank? Geek, Pocketbook Overview to COVID-19Get response to questions about your home mortgage, traveling, financial resources as well as keeping your comfort.What is a home loan broker? A home loan broker acts as a middleman between you as well as prospective lending institutions. Home mortgage brokers have stables of lending institutions they function with, which can make your life simpler.

The Single Strategy To Use For Mortgage Broker Meaning

Just how does a home loan broker get paid? Home mortgage brokers are frequently paid by lenders, occasionally by consumers, but, by regulation, never ever both. That legislation the Dodd-Frank Act also prohibits mortgage brokers from charging surprise charges or basing their settlement on a customer's rate of interest. You can likewise choose to pay the home mortgage broker yourself.The competitiveness and also residence prices in your market will have a hand in determining what home mortgage brokers cost. Federal legislation restricts how high compensation can go. 3. What makes home mortgage brokers various from funding officers? Loan officers are staff members of one loan provider that are paid set wages (plus perks). Lending policemans can create just the sorts of finances their company selects to offer.

Indicators on Mortgage Broker Salary You Should Know

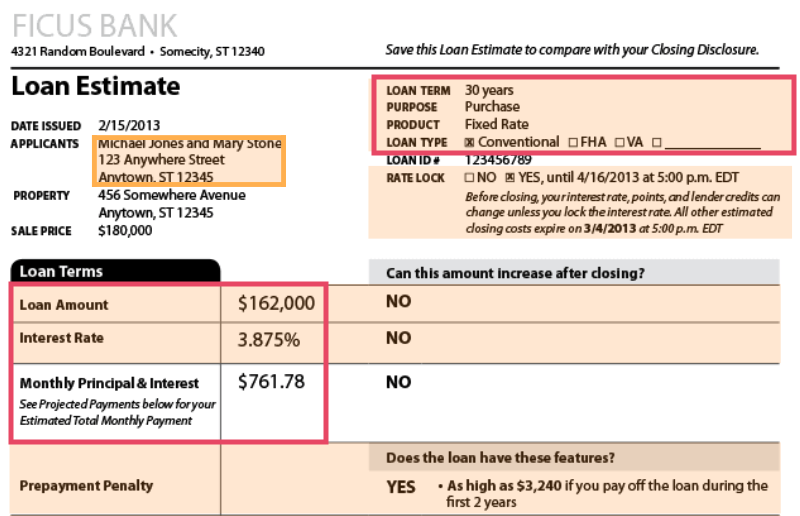

Mortgage brokers may have the ability to provide customers access to a wide option of car loan kinds. 4. Is a home loan broker right for me? You can conserve time by utilizing a mortgage broker; it can take hours to make an application for preapproval with various lending institutions, then learn the facts here now there's the back-and-forth interaction associated with underwriting the loan and also guaranteeing the deal stays on track.When selecting any kind of loan provider whether with a broker or straight you'll want to pay attention to lender fees. Particularly, ask what fees will appear on Page 2 of your Financing Price quote type in the Lending Costs area under "A: Source Charges." Then, take the Car mortgage broker exam loan Price quote you receive from each lending institution, put them side-by-side as well as contrast your rates of interest and also all of the fees as well as shutting costs.

The 6-Minute Rule for Mortgage Brokerage

Exactly how do I choose a home loan broker? The finest way is to ask close friends as well as family members for recommendations, but make sure they have in fact used the broker and also aren't simply dropping the name of a previous college roommate or a far-off acquaintance.

What Does Mortgage Broker Assistant Do?

browse around here Competitors and also home costs will affect just how much home mortgage brokers earn money. What's the difference in between a mortgage broker as well as a loan police officer? Home mortgage brokers will work with lots of loan providers to locate the very best loan for your scenario. Lending officers benefit one lender. Just how do I find a home mortgage broker? The best method to locate a home mortgage broker is through referrals from family, pals as well as your genuine estate agent.

The 7-Minute Rule for Mortgage Broker Association

Investing in a brand-new residence is one of the most complex events in a person's life. Residence vary substantially in regards to style, services, college district and, obviously, the constantly crucial "place, area, area." The home mortgage application process is a complicated element of the homebuying process, specifically for those without past experience.

Can figure out which issues may develop difficulties with one lending institution versus an additional. Why some buyers stay clear of mortgage brokers Often property buyers really feel more comfortable going straight to a big bank to secure their financing. Because instance, purchasers should at least speak to a broker in order to understand every one of their alternatives pertaining to the sort of lending and the offered rate.

Report this wiki page